Revenue Structure

Unit : Thousand Baht

| Product Line/Business Group | Operated by | % Shareholding Proportion of the Company | 2024 | 2023 | 2022 | |||

|---|---|---|---|---|---|---|---|---|

| Revenue | % | Revenue | % | Revenue | % | |||

| System | - The Company | - | 4,823,489 | 59.04 | 5,386,425 | 59.04 | 4,445,665 | 55.33 |

| - PLE Inter (Unima) | 99.99 | - | - | - | - | - | - | |

| Civil Works | - The Company | - | 3,936,104 | 42.53 | 3,352,855 | 36.75 | 3,271,182 | 40.71 |

| - PLE Inter (Unima) | 99.99 | - | - | - | - | - | - | |

| - PAR Joint Venture | 100.00 | - | - | - | - | - | - | |

| - Inter-Ausy Joint Venture | 80.00 | 494,729 | 5.35 | 384,117 | 4.21 | 318,225 | 3.96 | |

| Ban Aeur Ar-Thorn | - The Company | - | - | - | - | - | - | - |

| Others | - The Company | - | - | - | - | - | - | - |

| Revenue from Service Provision | 9,254,322 | 100.00 | 9,123,397 | 100.00 | 8,035,072 | 100.00 | ||

| Sales revenue | 141,081 | - | - | |||||

| Other Revenue | 221,886 | 226,039 | 189,698 | |||||

| Total revenues | 9,617,289 | - | 9,349,436 | 8,224,770 | ||||

Marketing and Competition Conditions

NatureofProducts and Services

Businesses operated by the Company, subsidiaries and joint venture (regarded as a whole as “Group of Companies”) can be categorized into 5 groups based on the nature of service provided, for instance, design, procurement, and electricity system installation, air-conditioning system, sanitary and fire prevention system, telecommunication system ICT and Seeurity systems, and civil construction. Besides, the Company has executed investment and development of the real estate business, with details of each category as follows:

| Electricity System |

|

| Air - Conditioning System |

|

| Sanitary and Fire Prevention System |

|

| Telecommunication System |

|

| Civil Construction Works | The Company operates general civil construction business, covering office buildings, commercial buildings, hospitals, department stores, educational institutes, hotels, accommodation, industrial plants, warehouses, airports and power plants, etc. |

Marketing and Competition

Significant Product and Service Marketing Policy

In developing the competition strategy and business policy of the Group, apart from maintaining the market share amid the intense competition due to the economic slowdown, the Group also emphasizes building the long-term competitive capacities. The Group’s competition strategies and business policies are as follows:

1. Reputation and experiences of engineering executives: Their capability and management have been proven as they can manage and bring the Group to survive during the economic crisis in 1997 and to continue to expand the business afterward. With practical experiences, valuable knowledge, widely reputable acceptance in the industry greater than 37 years, engineering executives can oversee and help the engineers who are the project managers of other projects. With these experiences, this enables the Group to quickly respond to any changes in the areas of engineering or new technology.

2. With their previous performance, the Group has highly gained acceptance and trust from customers for their work quality and service. Regarding the customers’ satisfaction, tremendous customers repeat the service with the companies and recommend us to other clients. The Group would like to maintain and enhance their reputation by performing the following key policies.

- Maintaining their quality and performance to be in the acceptable standard level

- Keeping integrity and business ethics

- Completing the project on time as promised to clients

- Taking care of customer’s benefits by considering the company as the owner of the project, and

- Offering after-sales service before and after the contract period

3. Capability of personnel – as human resource is deemed to be the most crucial factor of the business, the Group has a policy to enhance and improve skills and ability of staff members. The following policies will enhance efficiency and maintain the Group’s competitiveness.

- Continuous improvement of staff knowledge and skills both for technical and managerial knowledge

- Developing an accountability to the work and the society

- Creating satisfactory and friendly work atmosphere both for the individuals and the environment

- Teamwork and good cooperation between engineering team and other staff members is performed with the objective of providing excellence service to customers.

- Staff performance is measured by KPI and Balance Scorecard system, including Talent Management and the succession planning systems, which have been incorporated for the continuation of executive positions.

4. Strong financial position: the Group’s policy places high importance on strong financial structure by maintaining the debt to equity ratio in the low level as well as obtaining appropriate liquidity ratio. These shall mitigate the risks in doing business and enhance customer confidence toward the Group. As of 31 December 2024, the company’s Debt to Equity ratio was 9.19 and the gearing is 4.1 time with the liquidity ratio of 0.93 time as well as cash and cash equivalent of 39.38 million Baht. Besides, the company has been supported by commercial banks for business operations with the total credit facilities of 32,210.48 million Baht to support the business.

5. Efficiency of operational management: The Group establishes a policy to continuously develop central system for the operations and work process to enhance efficiency and ability to be responsive to customer’s demand. The Group has been certified ISO 9002:1994 for their quality management system since August 31, 2000 and ISO 9001 Version 2008 since October 2, 2003 from BVQI Co., Ltd. The company got certified of the quality management in the managerial system to be in line with ISO 9001:2008 by BVQI, who evaluated and certified the company’s continuality of the quality management system on October 28, 2015. BVQI will review the process every 6 months and also adjust the review process in the form of Process Approach. In 2017, the company has already received the international standard certification of ISO 9001:2015, which has remained valid until present.

6. Effective procurement: The Group has developed the procurement policy to create transparency and competition amongst suppliers to assure that production cost is within the appropriate level, as well as collaboration with supply chain partners in developing and improving work procedures and equipment.

Target Customers, Sales and Distribution Channels

Customer groups can be categorized into 2; private sector customers such as office buildings, commercial buildings,, accommodations, hotels, hospitals, department stores, industrial plants, etc., and public sector customers such as government bodies, state enterprises, whereby the service provision proportion in the past 3 years is as follows:

Unit: Million Baht

| Type | 2024 | 2023 | 2022 | |||

|---|---|---|---|---|---|---|

| Value | % | Value | % | Value | % | |

| Private Sector | 1,121.07 | 21.94 | 5,145.78 | 88.00 | 1,479.50 | 84.68 |

| Public Sector | 3,988.84 | 78.06 | 701.58 | 12.00 | 267.72 | 15.32 |

| Total | 5,109.91 | 100.00 | 5,847.36 | 100.00 | 1,747.22 | 100.00 |

Over the past 3 years, the Company has started to take on more of government projects, despite the fact that the participation in the bidding of government projects requires consideration of details stated in the Terms of Reference (TOR) of the hiring organization. The bidding participants must have track record of working with the government sector or having been registered with particular government institutes. Currently, the Company has registered with such organizations as the Mass Rapid Transit Authority of Thailand (MRTA), Provincial Electricity Authority, Provincial Waterworks Authority, Bank of Thailand, and the Ministry of Tourism and Sports, Bangkok Metropolitan Administration, Chulalongkorn University, and Airports of Thailand Public Company Limited (AOT), etc. However, the Group does have the policy to register with more organizations in order to enhance its capacity to take on more of government projects as the government has the policy to invest in different public utility systems, especially in electric power, mass public transportation and telecommunication on a continuous basis.

TThe projects taken on by the Group are contracting projects, assigned directly by customers or via subcontracting arrangements. Over the past several years, about 90% of the total project value has been generated from bidding, while the remaining has been generated from contacts and negotiation. The majority of the projects are ones that the Group got assigned directly by customers as the pricing and payment terms are more favorable. On the other hand, subcontracting projects serve more as a means to gain access to customers and new distribution channels via large construction companies or large international construction companies such as Italian-Thai Development PCL, Chor. Karnchang PCL, Sino-Thai Engineering and Construction PCL and Marubeni Corporation, to create a portfolio in government projects and overseas market, since the majority of the government project bidding or overseas projects are based on single contracts for construction and engineering, and the main construction contractor will engage subcontractors to execute the engineering works. In this regard, the proportion of projects obtained from direct customer contact and ones from subcontracting agreement in the past 3 years is as follows:

Unit : Million Baht

| Type | 2024 | 2023 | 2022 | |||

|---|---|---|---|---|---|---|

| Value | % | Value | % | Value | % | |

| Direct Contact | 5,109.91 | 100.00 | 5,680.51 | 97.15 | 1,672.84 | 95.74 |

| Subcontracting | 0.00 | - | 166.85 | 2.85 | 74.38 | 4.26 |

| Total | 5,109.91 | 100.00 | 5,847.36 | 100.00 | 1,747.22 | 100.00 |

Furthermore, the Group also focuses on building good relationships with customers in order to foster opportunities in taking on new projects from existing customers in the future. In 2024, the average proportion of projects from new customers is about 86.20%, and that of existing customers is about 13.80%. Current customers who have trust and credibility in the Company are, for example, Provincial Electricity Authority, Chulalongkorn University, Walialuk University, Lotus, Tops Supermarket, Central Plaza Department Store, CP Group and TCC, etc.

Competitive Landscape

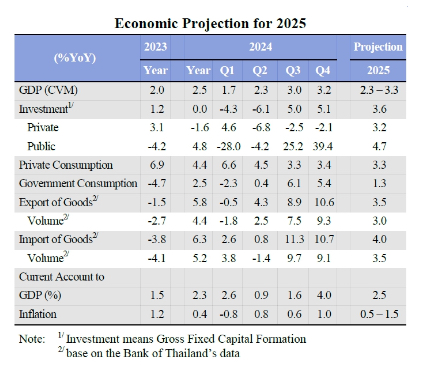

The Thai Economy in the fourth quarter of 2024 expanded by 3.2 percent (%YoY), accelerating from a growth of 3.0 percent in the previous quarter. After seasonally adjusted, the Thai economy increased by 0.4 percent form the third quarter (%QoQ sa).

On the expenditure side : Public investment and export of goods and service accelerated. Private consumption continued to expand. Nonetheless, government consumption expenditure decelerated while private investments contracted.

On the production side : The agriculture, forestry, and fisheries sector returned to growth for the first time in five quarters. Accommodation and food services, wholesale and retail trade, and construction sectors accelerated from the previous quarter. Meanwhile, the manufacturing, and transportation and storage sectors continued to expand.

Thai Economic Outlook for 2024

The Thai economy in 2024 grew by 2.5 percent, accelerating from 2.0 percent in 2023. Private consumption expenditure and government consumption expenditure expanded by 4.4 percent and 2.5 percent, respectively. Meanwhile, public investment grew by 4.8 percent, whereas private investment declined by 1.6 percent. The average headline inflation was at 0.4 percent while the current account recorded a surplus of 2.3 percent of GDP.

The Thai Economy in the Fourth Quarter and in 2024 in terms of Construction

Construction sector surged by 18.3 percent, accelerating from a 15.2-percent expansion in the previous quarter, driven by a significant increase in public construction, particularly government construction, while private construction continued to decline. In this quarter, public construction expanded by 40.8 percent, acceleration from a 31.9-percent expansion in the previous quarter. Government construction continued to expand for the second consecutive quarter, growing by 67.9 percent, driven by the construction of major projects under the Ministry of Transport, for instance, the national highway network project, the maintenance of the rural highway network, and the improvement of rural highway roads and bridges to support transportation and logistics. State enterprise construction continued to grow for the eleventh consecutive quarter, rising by 3.4 percent, following increased disbursement of investment budgets for major infrastructure development projects, such as the Purple Line urban train MRTA project (Tao Poon-Rat Burana section) and the second phase of the transmission and distribution system development project (PEA). Meanwhile, private construction declined for the third consecutive quarter by 3.9 percent, compared to a 6.0-percent decline in the previous quarter. This decline was due to a continued reduction in all types of residential construction, as well as non-residential and other construction project, expert for industrial building construction, which continued to expand. Construction Material Price Index (CMI) increased by 0.4 percent for the second consecutive quarter, mainly driven by price increases in other construction materials (5.8 percent), electrical and plumbing equipment (2.8 percent), concrete products (1.3 percent), and wood and wood products (1.5 percent). Meanwhile, the prices of key construction materials declined, such as steel (-2.8 percent) and cement (-0.9 percent).

In 2024,the construction sector grew by 1.3 percent, compared to a 0.6-percent decline in 2023. Public construction increased by 5.3 percent, with government construction rising by 6.4 percent and state enterprise construction growing by 3.5 percent, while private construction declined by 2.1 percent.

Thai Economic Outlook 2025

The Thai economy in 2025 is projected to expand in the range of 2.3-3.3 percent (with th midpoint projection of 2.8 percent). Private consumption expenditure and private investment are expected to increase by 3.3 percent and 3.2 percent, respectively. Export value of goods in US dollar terms is anticipated to increase by 3.5 percent. Headline inflation is estimated to be in the range of 0.5-1.5 percent and the current account is projected to record a surplus of 2.5 percent of GDP.

Supporting Factors

- The increase in government expenditure, particularly investment spending.

- The continued expansion of private consumption and the recovery of private investment.

- The sustained recovery of the tourism sector and related services.

- The continual growth of merchandise exports.

Risk Factors

- Risks from volatility of global economic and global financial market.

- High levels of household and corporate debts.

- Risks from volatility in agricultural output and price.

Economic management for 2025 should prioritize on :

- Preparing for cushioning the impact of trade policy changes by key trading partners by; (i) Emphasizing trade negotiations with the United States; (ii) Protecting the manufacturing sector from dumping and unfair trade practices; (iii) Promoting the export of high-potential and strategically beneficial products; and (iv) Encouraging businesses to mitigate risks from exchange rate fluctuations.

- Accelerating private investment to regain growth by; (1) Strengthening foreign investor confidence to attract Foreign Direct Investment (FDI); (2) Expediting the implementation of investment projects approved between 2022-2024 to initiate actual investments; (3) Developing a conducive ecosystem for targeted industries and services; and (4) Boosting productivity through innovation and cutting-edge technology.

- Accelerating budget disbursement is essential to ensuring the continued support of public expenditure to the economy. Particularly, capital expenditure disbursement should be achieved a minimum of 75 percent of the total investment budget.

- Raising awareness of ongoing government assistance measures to address household and business debt problems is essential to ensure that debtors, particularly small-scale debtors and SMEs, receive adequate support for debt restructuring.

- Ensuring the continued expansion of the tourism sector,immediate measures are required to address air pollution problem (PM2.5), as well as maintaining safety standards, and preparing infrastructure related to tourism, such as airport capacity and flight availability.

Source : Office of the National Economic and Social Development Council

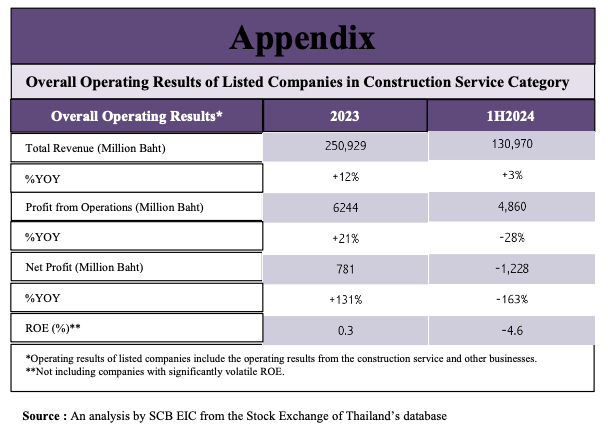

Construction Industry Outlook

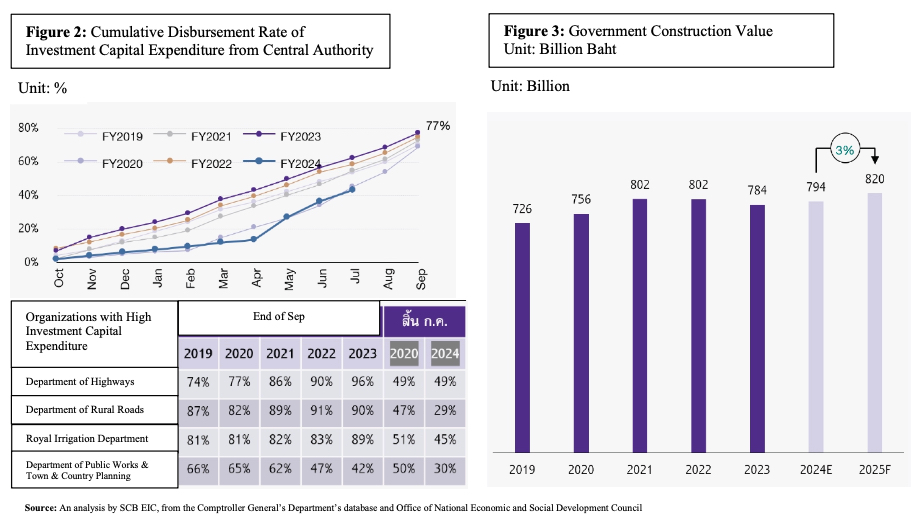

There was a sign of recovery of the government construction in the second half of 2024, and a growth tendency of 3% in 2025. In the first 4 months of 2024, the government construction sector encountered challenges in the form of delayed budgeting. However, the budget announcement in May 2024 resulted in an accelerated disbursement of cumulative capital expenditure. It was expected that the government construction outlook should improve in the second half of 2024, from an expedited disbursement of capital expenditure. In 2025, given that the annual budgeting is completed in time for the enforcement in September 2024 or with only a slight delay and timely disbursement, this will be a supporting factor for the government construction sector in 2025. SCB EIC is of the view that the government construction sector in 2025 is likely to expand by 3% YoY. Moreover, several organizations are planning to initiate a tender of transportation mega projects, presenting opportunities for large contractors and allowing opportunities for mid-scale and small-scale construction operators as subcontractors to generate revenue and improve liquidity.

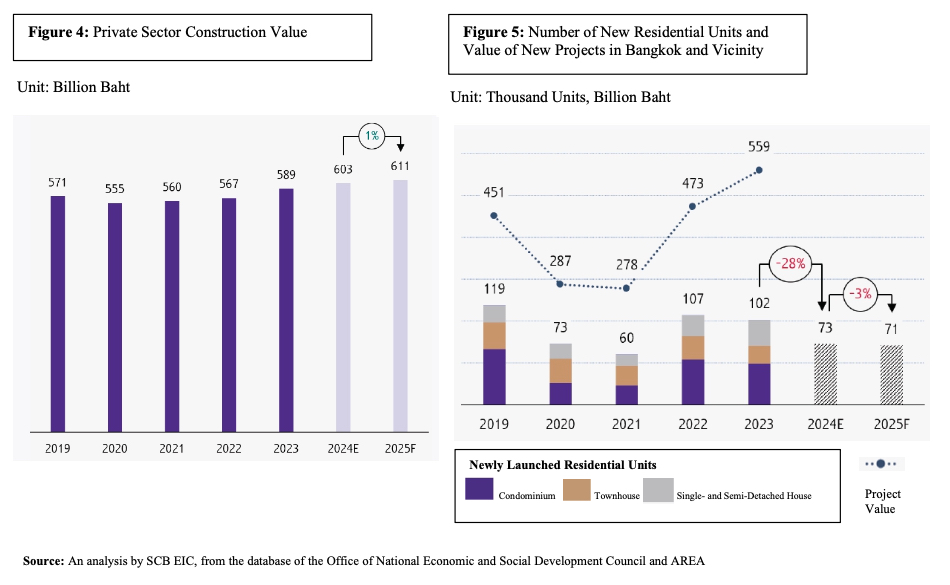

There is 1% growth tendency for the private sector construction in 2025. The residential construction sector is under pressure from a slow recovery of the residential market, especially from the mid-range and lower. However, entrepreneurs have turned to more of medium-upper price range projects, whereby construction costs also increase in relation to the project profiles. As for supply for retail spaces and office spaces for rent, there should be an addition of approximately 1 million square meters in 2024, while the supply for retail spaces and office space for rent should continue to increase during 2025-2027 at the average rate of 0-2% and 2-4% per year respectively. However, we still have to monitor the oversupply condition of office spaces that may result in the termination of projects with low potential, which can be a risk for the private sector construction in the future.

Going forward, we still have to watch out for environmental regulations that will be a condition to participate in the bid rounds of large-scale projects in a stricter manner. Construction operators who set the greenhouse gas emission target and indicators, as well as report the greenhouse gas emission reduction are more competitive in the bid rounds of large-scale projects for both public and private sectors.

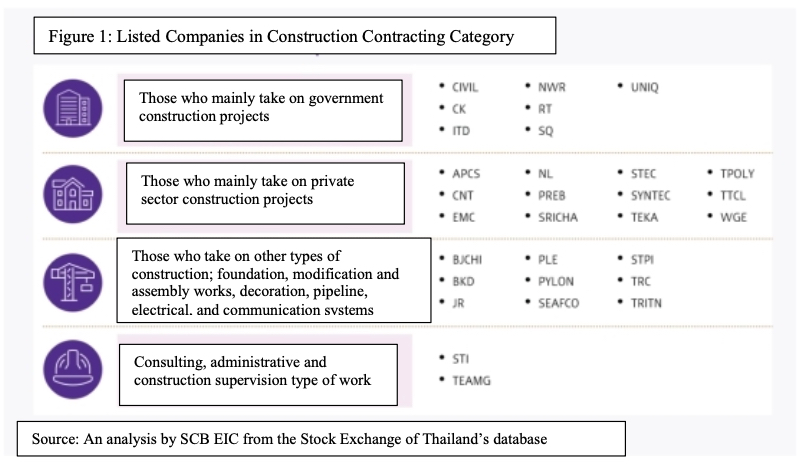

There are several players in the construction industry in Thailand, major contractors who are capable of taking on large-scale structures and complex projects, medium- and small-sized contractors who serve as subcontractors from major ones. They are capable of handling medium- and small-sized projects with less complexity. Construction contractors can be categorized into 4 main groups, namely 1) those who mainly take on government construction projects such as infrastructure 2) those who mainly take on private sector construction projects such as buildings, accommodations and factories 3) those who take on other types of construction such as foundation works, modification and assembly works, decoration, pipeline systems, electrical systems, and communication systems and 4) consulting, administrative and construction supervision type of work.

Recently, construction contractors, especially those who mainly take on government projects, have encountered challenges in the form of delays in the bidding process, budget disbursements and increased construction costs. The overall construction sector valued at approximately 1.4 trillion Baht per year. More than 57% of which is the private sector construction, whereby 19 large-scale construction contractors have a joint market share of about 15% of the total construction value. Meanwhile, the remaining market share of 85% is distributed among medium and small contractors, which results in diverse construction activities and generates revenue to relevant businesses in the construction supply chain such as construction materials manufacturing and distribution business, design and interior decoration business, consulting and construction supervision business. In the past 1-2 years, construction contractors have faced challenges in operating the business, especially major contractors who mainly take on government construction projects, caused by the delayed schedule of the tender process, new government construction projects as well as construction material prices, especially steel and cement, and higher labor costs. Meanwhile, there are still limitations to adjusting the reference price in the government construction project tender process, and the budget disbursements are still delayed, leading to the liquidity issue for major contractors who mainly take on government construction projects. The rippling effects can be felt upon medium- and small-scale contractors as well. The data from the Department of Business Development stated that 2,306 construction contractors closed their businesses in 2023, increasing by 7% from 2022 that reported an increased rate of 30% from the year before, while the incorporation of new businesses in 2023 decreased by 8% compared to 2022.

The government construction outlook in 2024 has shown signs of recovery in the second half of the year, after the announcement of the 2024 fiscal budget. In 2025, the government construction value is likely to expand by 3%. In the first four months of 2024, the government construction sector has been challenged by budgeting delays as 2024 is the year of a major election and the establishment of a new government, causing the cumulative disbursements in the first four months of 2024 to be much slower than usual. However, the announcement of 2024 fiscal budget in May 2024 has resulted in an expedition of cumulative disbursements of capital expenditure and recovered to a similar threshold to that of 2020, when there was also a delay in fiscal budgeting. SCB EIC forecasts that the government construction sector has shown signs of recovery in the second half of 2024, with an expedition of capital expenditure disbursements, especially in the third quarter of the year, which is towards the end of the fiscal year.

If the fiscal budget for 2025 can be executed within the timeline and announced by September 2024, or only slightly later than this, allowing for a timely disbursement, this will be a supporting factor for the government construction sector in 2025. SCB EIC is of the opinion that the government construction value in 2025 is likely to expand by 3% YoY, whereby contractors who mainly take on government projects have the opportunity to participate in the bid rounds for the fiscal year 2025. Moreover, different organizations have planned to initiate tenders of infrastructure projects, especially mega projects in the transportation sector. It is forecasted that project tenders that will be released in 2024 and 2025 are, for instance, Khon Kaen – Nong Khai parallel-track train phase 2, Bang Khun Tian – Bang Bua Thong Motorway Route 9 western Bangkok Outer Ring Road, and passenger terminal at Suvarnabhumi Airport – east side extension. These projects contribute to generating revenue from the government construction sector from 2025 onwards. This is considered an opportunity for major construction contractors to participate in the project bidding, resulting in rippling effects for medium and small-scale construction contractors as subcontractors to generate more revenue and improve their liquidity compared to 2024.

Furthermore, there are mega projects in the transportation sector that are under study and are in the process of obtaining approval, for instance, parallel-track train phase 2, new sky train lines and extensions in Bangkok and vicinity, which will gradually generate value and revenue from the government construction sector in the medium term.

The private sector construction value in 2025 is likely to expand by 1%, whereby residential projects have been pressured by a slow recovery of the residential market, while the oversupply condition for the office space for rent still has to be monitored, which may lead to termination of low-potential projects. The private sector construction in the residential market is encountering a slow recovery, while household debt remains high, posing obstacles for the financing access. Prices of new accommodation projects have also increased, which is a challenge for newly launched projects, especially medium-range and lower. However, real estate developers have turned to launch more of medium to high range market, leading to the increased price of new projects. Apart from the land price continuously on the rise, construction costs have also increased in relation to the project profile in the medium to high price point, which will contribute to generating monetary flows from the private sector construction in the residential market, despite the decrease in the number of newly launched units.

Large-scale commercial construction projects are still being continuously executed, whereby real estate developers have expanded to retail spaces and large-scale mixed-use projects in business and tourism districts, as well as A-grade office building rental, resulting in a potential expansion of office rental supply of approximately 1 million square meters in 2024, reaching 19.1 million square meters. Also, when considering the launch of new projects, SCB EIC is of the opinion that retail space and office rental supply should continue to increase at the average of 0-2% and 2-4% per year from 2025-2027. This is a supporting factor in generating revenue from private sector construction activities in the medium term. However, the oversupply of office rental still has to be monitored, as it may lead to termination of low-potential projects, which can be a risk to the private sector construction in the future.

High potential construction contractors are those who collaborate with strategic partners, enabling them to bid on a diverse range of projects, control costs, and adapt their strategies to align with trends of environmentally friendly construction. Large-scale infrastructure project tenders remain dominated by major contractors with specialized expertise, extensive construction experience, and strong potential in operating public-private partnership (PPP) projects. However, delays in new government construction project tenders pose a significant risk in 2024 and beyond. Therefore, contractors with the flexibility to adjust their organizational strategies in taking on public and private sector projects in response to changing situation will be better able to maintain revenue and liquidity. Additionally, intense competition in project bidding results in high potential construction contractors forming partnerships with alliances, allowing for a more diverse access to different variety of construction projects.

Furthermore, high potential construction contractors also include those who are able to respond to real estate developers for large-scale environmentally friendly buildings such as residential projects, mixed-use projects, retail spaces, office buildings, factories, from the real estate project level and energy-saving buildings to projects that apply for sustainability standards such as Global Real Estate Sustainability Benchmark (GRESB), Leadership in Energy & Environmental Design (LEED), Green Building in accordance with the Thai’s Rating of Energy and Environmental Sustainability (TREES).

For medium- and small-scale construction contractors with competitive potential, they are capable of operating construction projects and committing on-time delivery as planned. Not only can they take advantage of timely disbursements, allowing them to maintain revenue and liquidity, but they can also maintain their capacity of subcontracting from large-scale contractors amidst intense competition, where large-scale contractors have a diverse array of medium and small contractor alternatives to choose from.

In this regard, even though major construction materials costs such as steel and cement tend to decrease in 2024 and continue to decrease in the medium term, prices remain at a high level compared to the past. Besides, there are volatility factors such as energy price, exchange rate, coupled with the high labor costs in relation to the increase in minimum wage going forward, resulting in construction contractors prone to high risks to initiate price competition in the bid rounds, leaving them exposed to the chance of running into a loss from operating the project, while contractors who are better able to control costs through advanced construction materials procurement agreement in relation to demand, and the use of construction technology to replace human labor are better positioned to maintain profitability.

It is undeniable that the ESG trend has put pressure on construction contractors to adapt, especially in the environmental aspect, where buildings and construction usually release around 40% of the total greenhouse gas emission. The construction sector involves construction materials that have high greenhouse gas emission rate in the manufacturing process, as well as energy consumption in construction sites, office buildings and transportation of construction materials. They also produce dust, noise, wastewater, sewage and waste from construction. In this regard, large-scale construction contractors are using environmentally friendly construction materials such as hydraulic cement, recycled construction materials, and improvements in construction procedures, for instance, waste reduction by adopting construction technology such as Building Information Modeling (BIM), pre-cast, prefabrication and modular units, equipment and machinery that reduce pollution. Meanwhile, medium- and small-scale construction contractors are also improving their construction procedures, for instance, reduction of construction waste and residue.

Going forward, the environmental regulations still need to be more strictly monitored as they will be the conditions to meet for participation in large project tenders for both public and private sectors. Therefore, construction contractors who can form strategic alliances with the manufacturers and construction material traders that are environmentally friendly to enhance energy efficiency, and have invested in construction technology that reduces pollution, together with the identification of targets and indicators of greenhouse gas emissions reduction, and the reporting of GHG reduction results, will be better equipped with the capacity to participate in large-scale construction project tenders in the future.

Source: SCB Economic Intelligence Center

Competitive Environment and Potential

The competition from the numbers of companies in each business sector may reflect the competition situation in the market at certain level that the construction business for the SMEs may be the most aggressive. It is because of there are less barriers of entry due to fewer funds for investment, technology, expertise, and management when it is compared with a large contractor. Despite there are some obstacles in terms of the regulation and standards of business operation, the entry into the market is no difficult. Thus, there are many small contractors in the construction business.

The market for the large entrepreneur is of less competition due to high barriers of entry since the market requires a large amount of investment fund, more experience and expertise in particular areas. On the other hand, the competition in the market for middle entrepreneurs may have competition of which depends on volumes in each situation. When the economy is going well, the construction projects are quite a lot and the competition is not quite aggressive. However, if the economy is slowdown, the construction projects decrease in numbers, leading to serious competition since the numbers of the contractors have not changed. In addition, if there are large contractors in the competition, the competition is even more aggressive which may lead to the price war of the construction fees.

Moreover, when the competition is considered by the types of work from the government and the private sector, it is found that the construction market of the government sector, the government sector has its procedure of pre-qualification to select appropriate contractors based on standards such as minimum financial status, minimum equipment and machine, and minimum personnel. Also, the market of the government’s construction has clearly classified the project’s value. The large contractors will involve in large projects only. Thus, the high value government’s projects are always with the large contractors, reflecting a mild competition when it is compared with the contractors in other markets.

In terms of the private sector construction market, although most of the construction companies are listed companies in the Stock Exchange of Thailand, the competition in the private sector construction market is quite aggressive, after consideration of the number of the projects that the contracts have already been signed, it is found that the distribution of assignments has been quite thorough, both for condominium and housing projects. During the economic crisis, the private sector construction market usually encounters high competition which leads to price cuts for survival.

Hence, the demand for construction services particularly in civil construction, design, procurement and installation of MEP for new projects and old buildings under renovation has an opportunities to grow respectively. The contractors who have strong financials and reputation of completion of quality of works will have good potential to acquire more businesses as they are more flexible in taking on large, medium and small-scale projects. Large contractors in Thailand including the Company usually have strong negotiating power with suppliers of materials and equipment to obtain better price and conditions. The company’s good track records and continued development in quality of works during more than 37 years in this industry is very significant part to encourage its competitiveness and create the opportunities to grow further and create stronger confidence for customers. This can be seen from the Company’s past performance in controlling and managing projects to complete on time within the quality required by customers, as well as the Company’s ability to generate profits over the years. In this regard, since the Company’s business covers customer bases in the construction sector for accommodation, commercial and industrial construction, which are new projects, renovation or improvement of the building engineering system for old factories, the negative impact from any particular business sector has a rather limited impact on the Company compared to other competitors,

Apart from the competition among the Thai contractors, the foreign contractors through its direct investment and joint ventures with/Thai partners are also main competitors. The determination of the market share is quite challenging as no organizations have compiled this data. Besides, compiling the contractor information by their expertise, experiences and work quality is also difficult, as the installation works to make sure the system can operate is something that is quite easy for experienced engineers, but the quality, neatness and the lifetime of the system, as well as the ability to prepare the system is something more complicated, and each contractor has different capacity, which takes time to prove in order to categorize their expertise.

In 2022, the Company had participated in several bid rounds for public and private sector construction projects and won 10 projects altogether, with the total value of 1.8 million Baht, which was lower thanthetarget due to the outstanding works on hand valued at over 10 billion Baht from 2021. After revenue realized in 2022 of 7.84 billion Baht, the backlog at the beginning of 2023 stood at 15.7 billion Baht that will be realized in 2023 andthefollowing years. Besides, the Company also planned to participate in large infrastructure project bid rounds with major construction contractors in Thailand and overseas, as well as taking on assignments from major private sector customers, wherebyadditionalprojects shouldbe acquiredin 2023 of about 12.2 billion Baht.

In 2024, the Company participated in the bid rounds for several government and private sector projects, and won 12 projects in total, equivalent to the project value of 5.11 billion Baht, which is lower than the target given the carried over backlog from 2023 of more than 15.1 billion Baht. Therefore, after realizing revenue in 2024 of 8.76 billion Baht, the backlog at the beginning of 2025 amounted to 10.74 billion Baht that will be realized in 2025 and the upcoming years. Furthermore, the Company intends to participate in large-scale infrastructure bid rounds with major construction contractors in Thailand and overseas, as well as taking on assignments from the major private sector organizations. It is expected that the additional projects to be acquired in 2025 should be approximately 14.5 billion Baht. Even though the Company’s operating results in 2024 did increase, the loss was quite significant and the bidding success for construction projects did not meet the target. The Company’s total revenue was reported to be 9.62 billion Baht, increasing by 2.8% compared to 2023, with the revenue of 9.35 billion Baht. In this regard, 96.3% of the revenue was generated from the construction business, and the rest was from other sources. The Company reported a gross loss of 4.4%, compared with the gross profit of 7.2% in 2023, resulting from the increase in core construction materials’ costs such as steel, concrete, electrical cords, as well as increased labor costs; both for direct labor and subcontractors. There was also an increase in rework costs from subcontractors and preliminary costs for construction projects.

The Company has made improvements to the work procedures for increased efficiency and effectiveness, focusing on delivering quality and timely commitment to customers, keeping operational costs within the budget and timely collection of construction fees. Moreover, departmental strategies have been identified to follow the ESG framework, with the emphasis on environmental conservation in the project sites, in terms of waste and pollution that may impact the operators or surrounding communities. The focus is placed on safety, hygiene and good environment, through a selection of materials that have the least impact on the environment, especially stressing on the participation to reduce greenhouse gas (GHG). There are waste sorting projects on every site to induce recycling initiative. The Company is committed to clear goals in improving operational procedures and getting certified of the ISO 14001:2015 and ISO 45001:2018 by the middle of 2025. Furthermore, the Company encourages human capital and labor development by adhering to the human rights framework, fostering knowledge and competencies on construction techniques and system installation, which form a major part that makes the Company’s performance outstanding to customers and the public. The Company has been placing emphasis on value chain, with exchange of knowledge and experiences, as well as provision of innovation support for construction and new construction materials. All these improvements and execution form a significant foundation for the Company’s sustainable prosperity in years to come.